From shortsea to deepsea shipping

Coos Blaauw has been a charterer with Wagenborg for 30 years, and Koos Zumkehr for no fewer than 35 years. Hans Kroon follows up with a respectable 21 years. All three were there at the start of Wagenborg’s growth from just coastal shipping to also “deep-sea” shipping. So there’s one thing they agree on: “The scale of our clients, increasing world trade, and the fact that Wagenborg was able to commission ships have greatly expanded our trading area since the 1990s”.

“When I joined the company in 1988,” says Coos Blaauw, “We had an old fleet of mainly 500-tonners, and the smallest had a load capacity of only 240 tonnes! The vessels in our fleet mainly belonged to private shipowners; Wagenborg’s own fleet was just small. We had a total of about 40 ships carrying freight in a market that was not all that good.” In the mid-1980s there was a changeover within Wagenborg, with Egbert Vuursteen becoming commercially responsible for the shipping business. “The business slowly got going again. The Ferus Smit shipyard started series construction. No fewer than nine 1500-tonners and five 1300-tonners were delivered to Wagenborg and associated shipowners,” says Mr Blaauw.

Series rather than one-offs

Wagenborg’s philosophy is “We don’t just earn money from ships but also with them”. That meant that the company needed more vessels of its own, forming a large fleet, whether or not in cooperation with private shipowners. In 1990 an extensive new construction programme started, consisting of six ships of 3000 dwt: the Flinterborg, Balticborg, Eemsborg, Bothniaborg, Rijnborg, and the Scheldeborg. Koos Zumkehr explains: “The 3000-tonners were vessels with box-shaped holds for our own company. The fleet of affiliated captain-owners was also expanded considerably.” Between 1992 and 1996, Bijlsma Wartena delivered no fewer than 17 Bijlsma traders with a load capacity of between 2200 and 2500 tonnes. That series was the result of excellent cooperation between Wagenborg, captain-owners, and the shipyard, and for Wagenborg it was to be an important point in further development of the Finnish market.

Development of the Saimaa trade

“Sometimes you just need to be lucky with chartering,” Coos Blaauw comments with a laugh. “The first Bijlsma trader, the ‘Gelre’, had a capacity of 1700 tonnes of paper from the Saimaa area of Finland. We had put this ship on a time charter with an operator because we didn’t have experience with that area yet. When the second Bijlsma trader was constructed, the ‘Steady’, we had the opportunity to install a deeper hold, which increased the paper capacity by no less than 400 tonnes. That gave us a capacity of 2100 tonnes rather than 1700 tonnes – the same costs but more income.”

This was the start of the development of this niche, which has since become an important area, in cooperation with the private shipowners. “In developing this trade, we achieved a lot together with our private shipowners. Jan van Dam en Henk Danser were particularly successful in this regard. They helped ensure that the Bijlsma trader was followed by a series of 12 new, optimised Samaix vessels.”

Expansion in the Baltic

As Coos Blaauw explains, freighting in the 1990s was very different to nowadays: “Back then, there were few contracts, with the exception of timber. It was mainly freighting on a spot basis. As the freight shipper, you were responsible for both the freighting and the operations of a number of ships. At that time, our area of operations extended from northern Spain to Kemi in the north of the Baltic, with the private owners not sailing that far north because they weren’t classified for travelling in ice. Our trade focused on ‘timber, cold, and salt’, but without all the timber trade from the continent. For example, we had no direct contact with Finnish or Swedish timber producers.” With the Saimaa vessels, it was suddenly possible for Wagenborg to ship cargo back and forth from the Saimaa area, which was interesting for timber and paper clients like Stora Enso.

Starting in 1996, the then chartering director Jaap Teekman developed a new series of 4000 tonners in collaboration with Henrik Sjölund (Helsinki Chartering), and of course the shipyard. This “G series” with box-shaped holds – consisting of the Geulborg, Gouweborg, Griftborg, Gaastborg, Giessenborg, and Grachtborg – led to the development of different cargo flows than just timber and salt. Cellulose and steel were carried too. “Big shipping companies like Transfennica were then shipping large consignments for the Swedish and Finnish pulp and paper industry,” says Mr Blaauw. “Our 4000-tonners proved to be perfect vessels for the smaller batches of that kind of cargo. So as a result, Wagenborg started to make a name for itself in the Baltic.”

Bigger ships, bigger operating area

The growth of the Wagenborg fleet continued in the mid-1990s, not just in terms of the number of vessels but also certainly in terms of tonnage. Koos Zumkehr explains: “The economy was doing really well at that time. A lot of our clients were growing because of expansions and acquisitions, and those additional production facilities also created a greater demand for transport by ship, not just in the Baltic but also further afield. Wagenborg was then able to commission vessels at a time when clients were increasing their scale and world trade was expanding, which I believe led to our expanding our trading area.”

Hans Kroon explains: “I joined the company in 1997 and experienced that development from up close. The first 6000-tonners in our fleet were built by the Ferus Smit , for example the Namai, the Morgenstond, and the Flinter. The 9000-tonners later came from various shipyards in the north of the Netherlands. The growth of the fleet was unprecedented; the expansion in tonnage was 400%! There was a point when two ships were being launched each month!” Coos Blaauw continues: “The 6000-tonners were, in particular, for the private owners who had the will, knowledge, skills, and capacity to grow along with Wagenborg; Rederij Pot is a good example.”

First transatlantic journey

The year 1995 saw the first of twelve 9000-tonners, the “Kroonborg”, being taken into service. Besides the K series, the M series, D series, and V series were also added to the fleet. The market was favourable. “The market was good,” says Hans Kroon, “and I also had the scope for arranging trades for those 9000-tonners. Learning to work with that size of vessel took some getting used to, because up to now we had mainly used 4000-tonners. It sometimes happened that I had arranged for a 9000-tonner and Coos was then left with two empty 4000-tonners. That’s unthinkable nowadays!”

Scale remained important in the market in which Wagenborg was operating. “The way our clients became more international more or less forced us, as freighters, to grow along with them and to expand into areas that were new for us,” says Hans Kroon. “Based on our good relationship with Ruukki we arranged the Kroonborg’s first ever voyage from the Finnish port of Raahe to the Great Lakes in North America. This was new business for Ruukki too. For us, it was our first transatlantic journey. And the great thing was that instead of sailing back just with ballast, we were able to pick up a return cargo of paper on the St Lawrence Seaway, for use in producing the Yellow Pages in Amsterdam. That historic return journey by the Kroonborg was the first of many from the Baltic to the Great Lakes carrying steel and back carrying paper.”

"With the Kroonborg we made the first Atlantic crossing in 1995"

Coastal versus deep-sea shipping

Nevertheless, Wagenborg has always tried to retain a fixed base in Sweden and Finland for coastal trading. Hans Kroon explains: “Other trades have come our way too. Our coastal shipping clients were a major factor in our logical next step into deep-sea shipping, which is a totally different game. The difference between coastal and deep-sea shipping is of course that coastal shipping doesn’t cross the ocean. Another difference is that coastal shipping serves the client’s domestic market, whereas deep-sea serves the international market. Freight shipping in this segment is much more a matter of speculation, and it involves more variables, with clients often having various production locations. As a shipping company, we can make a difference by having excellent logistics, whereas in coastal shipping it’s often mostly about the price.”

Focus on the client

Working closely with its clients, Wagenborg continues to develop internationally. Hans Kroon explains: “In 2001 Stora Enso was expanding in the United States. Wagenborg had become a familiar face in the Great Lakes and the market was talking about us. We began using our 9000-tonner to ship timber pulp for Stora Enso to Menominee on Lake Michigan. We also use this type of vessel for transporting sugar beet pellets to Europe for Feedimpex. That’s a good example of how we think along with the client in terms of logistics. They could now load their product directly from their Duluth location into our 9000-tonners, instead of first having to send it to the seaport of New Orleans. Wagenborg’s future lies in actively thinking along with the client and being flexible.” Customised maritime solutions for Wagenborg’s clients are also to be found in the special B series and S series, dedicated vessels operating for Smurfit Kappa and Stora Enso respectively.

Based on the conviction that Wagenborg wants to be close to its clients, a number of local offices have been set up over the years, such as in Montreal in 2003 and in Malmö in 2001. This attitude is widely appreciated. “It may seem strange at times, but it’s remarkable that we’ve been doing business with the same clients for so long. In my opinion, though, that tells you everything about how we work, because we aren’t necessarily the cheapest,” says Koos Zumkehr. "The name Wagenborg and the performance it provides stand for reliability, and were already appreciated back then as “finally a good alternative on the market”.

Growth and scale

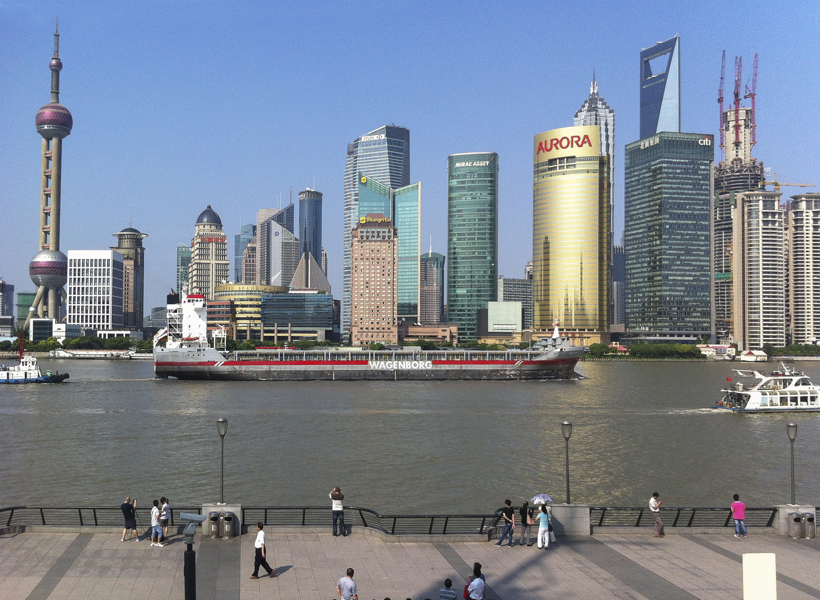

At the beginning of the 21st century, the new building programme was running smoothly, even in crisis years. It meant that the average age of the fleet was unprecedentedly low. In the Netherlands, a new series of 4200 and 6000-tonners were first launched, followed by the E series, F series, Vxl series, and R series; in China, 24 ships were delivered in the course of only seven years. The fleet thus consisted of over 180 vessels, varying from 2000 to 23,000 tonnes, with and without a classification for ice and with and without on-board cranes. They belonged to Wagenborg itself and to private shipowners. This increase in scale made it possible for the company to grow further. “With the presence of the A-types,” says Hans Kroon, “Wagenborg, along with its clients, has been able to guide the American paper industry. The arrival of the F series – whose draught makes is ideal for the Great Lakes – has only strengthened our position in this trading area. We’ve also explored other deep-sea trades with our A series ships, for example in the Far East and to Luanda (Angola).”

Future challenges

Koos Zumkehr explains: “Nowadays we deploy our fleet worldwide. As the chartering department, we do a lot of work, with 25 people in Delfzijl and at our foreign offices.” The department handles some 11,000 port calls and 5000 journeys annually. If you interpret this lean and mean organisation in terms of costs per tonne of cargo, Wagenborg is one of the leaders in cost-price terms compared to other shipping companies. “But still, there’s no area where we’re the absolute best, and that’s not in fact possible”, says Koos Zumkehr. “Hans has his ships operating in Korea, Cleveland and California, while Coos’ ships travel between Finland and Bilbao. I see us as like a really good decathlon competitor.”

Mr Zumkehr concludes by saying: “Whether we like it or not, it’s the market that dictates things. Despite the crisis, we’ve been able to keep our product at a level above that of our competitors. When I consider those competitors, including those that no longer exist, I think we’ve always been able to make the right choices by staying true to our own identity. It’s also very important that the fleet as a whole has remained intact. That’s another sign of confidence on the part of both our clients and the banks. Doing business personally is central to our business, with the company showing great interest in the client and its product and market. But it’s not just a matter of gut feeling: if Wagenborg combines the enormous amount of knowhow, skills, and data within the company, much more will be possible in the rapidly changing IT world around us. I think that’s also our greatest asset nowadays.”